Data Snapshot: Europe needs more funding for food waste, circular economy startups

Circular economy tech hasn’t made a lot of headway among European investors. But startups that are finding new uses for biowaste from agrifood and other sources are helping unlock €1.8 trillion ($1.89 trillion) in potential value on the continent.

Every year, Europeans waste 88 million tons of food – that’s 173 kilograms per person. Startups like Olio, Too Good To Go, Oddbox, Babaco Market, KITRO, Zero-Gachis, and others are working to curb food waste through various downstream interventions.

OddBox in the UK and Italy’s Babaco Market sell ‘wonky’ fruits and vegetables from producers – ones that are fit for consumption but not pretty enough for supermarket stocking.

Also in the UK, Olio connects consumers to restaurants, supermarkets, and stores with surplus food that would otherwise go unused. France’s Zero-Gachis and Denmark’s Too Good To Go operate on similar models.

Meanwhile, Switzerland’s KITRO and the Netherlands’ Orbisk make monitoring devices and software for businesses and consumers to track and prevent food waste.

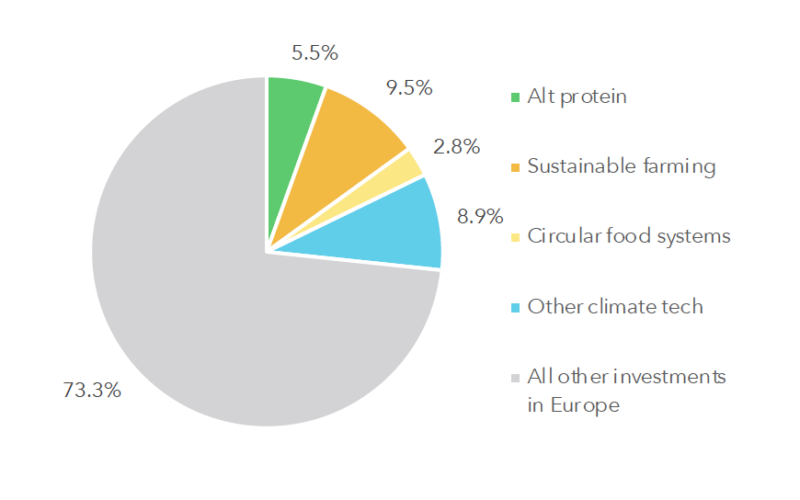

Food waste-focused agrifoodtech ventures raised $239 million in funding between them in 2021, or 2.8% of all agrifoodtech investment on the continent (see chart below.) The data was released in AgFunder and Invest-NL‘s Europe-focused ‘Climate Investing’ report, released as part of AgFunder’s Europe 2022 Agrifoodtech Investment Report.

The fact that most circular economy agrifoodtech startups are early stage partly explains the small sum of capital flowing into them; lack of priority from investors, however, is largely to blame.

Upstream impact

Anti-food waste startups comprise the largest share of Europe’s circular economy startups that raised funding last year. Such companies are helping curb more than €143 billion ($144 billion) in lost food value each year – and not just on the downstream end.

Upstream, Forenamics in Germany provides forecasting-as-a-service to help food producers anticipate demand for their products. The UK’s Mimica is making smart packaging to prevent food spoilage and improve food safety.

In Denmark, Carbo Culture is capturing food and other biomass-based waste streams close to the source and turning them in to an alternative fuel source.

Only a few upstream food waste ventures raised funding from investors in Europe last year. But curbing waste father back in the value chain is where the greatest impact potential is, according to a 2020 report from the European Environment Agency.

“Reducing the demand for food by preventing food waste can decrease the environmental impacts of producing, processing, and transporting food. The benefits from reducing such upstream impacts are much higher than any environmental benefits from recycling food waste,” the report states.

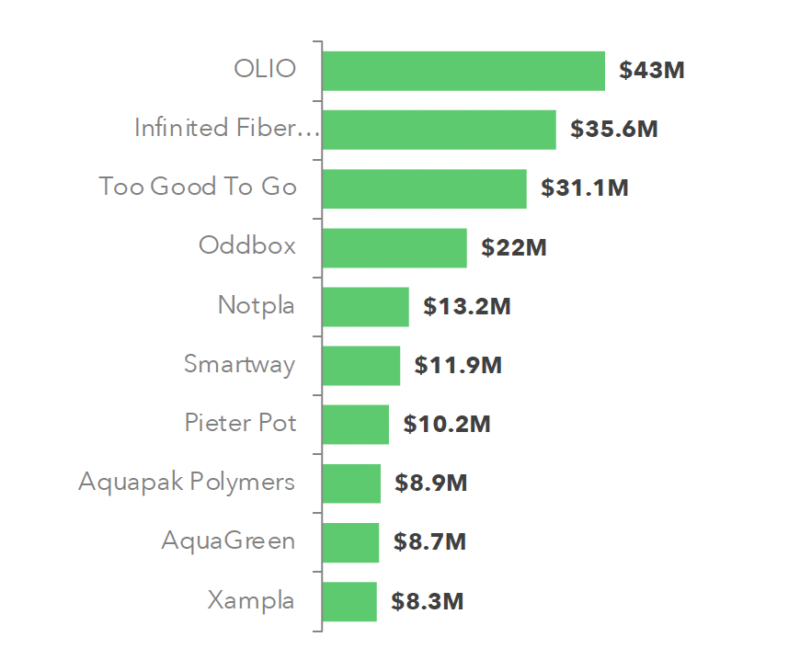

Top 10 funding deals for European circular food systems startups 2021

Alt-plastic

Startups making and using more sustainable food packaging raised just over a quarter of circular economy capital in Europe’s agrifoodtech sector last year. A few are developing sustainable or upcycled alternatives to traditional, fossil fuel-based plastics; among them is Finland’s Woodly, which is developing wood-based packaging material, and UK-based Kelpi, which makes biodegradable plastic from seaweed.

In the Netherlands, Pieter Pot is a zero-waste online grocery company that uses only plastic-free packaging for its products. Pyxo, from France, is trying to encourage companies and restaurants to switch to reusable food containers by setting up a collection, cleaning, and logistics network. &Repeat from Sweden is a recycling company focused on disposable food packaging.

A handful of startups are tackling agricultural waste streams with other creative approaches. Finland’s Infinited Fiber raised $35.6 million last year to turn waste materials like wheat and rice straw, and cardboard, into textiles that mimic cotton. Italy-based Ricehouse uses — you guessed it — rice waste to create new forms of construction materials.

For now, the circular economy remains a niche sector for European agrifoodtech investors – despite the enormous untapped value in preventing and repurposing waste streams.